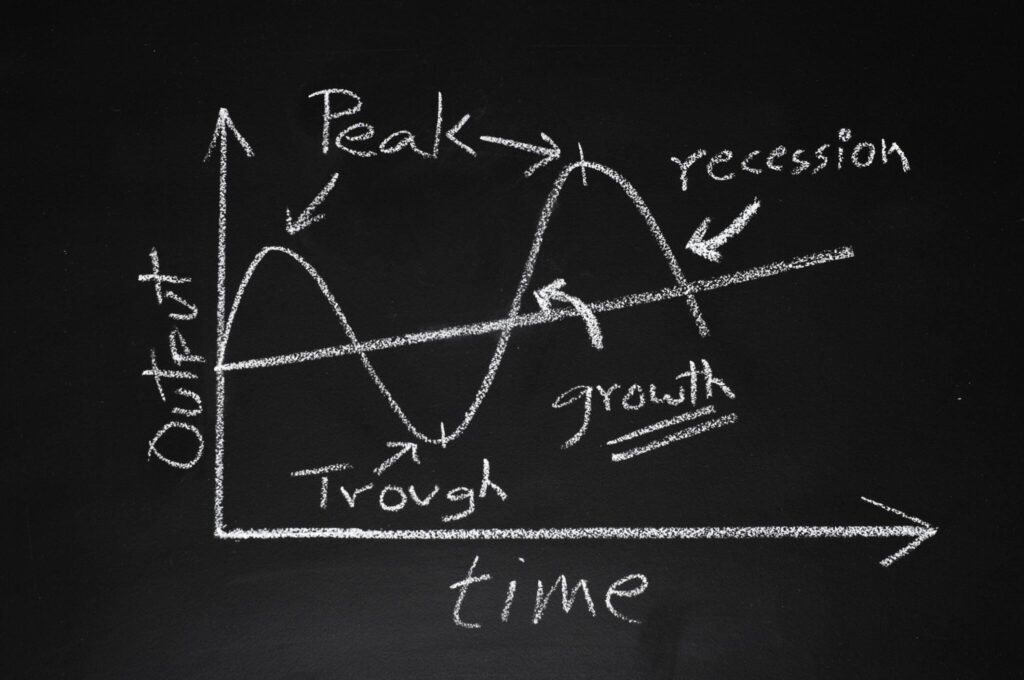

The Indian economy, a vibrant tapestry of diverse sectors and aspirations, pulsates with the rhythm of economic cycles. These cyclical fluctuations, marked by periods of expansion and contraction, cast a significant influence on investment decisions, shaping the fortunes of individuals and businesses alike. To navigate these dynamic waters and make informed choices, understanding the impact of economic cycles on Indian investments is crucial.

The Four Seasons of the Economy:

Economic cycles are a rhythmic dance, following a distinctive four-stage pattern: expansion, peak, contraction, and trough. Each phase brings forth unique challenges and opportunities for investors, shaping investment strategies and outcomes.

1. Expansion:

Characteristics:

• Robust economic growth.

• Rising consumer confidence.

• Increasing corporate profits.

Market Dynamics:

• Low-interest rates fuel investment and borrowing.

• Investors can target growth-oriented assets, especially equities in sectors on the upswing.

2. Peak:

Features:

• Growth slows down, and inflation emerges.

• Asset prices may reach their zenith.

• Rising interest rates.

Investor Approach:

• Caution is advised.

• Consider shifting towards defensive assets like bonds or gold.

3. Contraction:

Characteristics:

• Economic activity declines.

• Unemployment rises, and profits dwindle.

Financial Landscape:

• Falling interest rates.

• Access to credit tightens.

Investment Strategy:

• Prioritize capital preservation.

• Explore value investing and focus on defensive sectors.

4. Trough:

Attributes:

• Economic activity stabilizes.

• Inflation may ease.

Market Scenario:

• Interest rates hit their lowest point.

• Opportune time for bargain hunters with a long-term perspective.

Understanding these cyclical phases empowers investors to navigate the economic landscape strategically. Whether seizing growth opportunities during expansion or safeguarding assets in a recession, aligning investment strategies with economic cycles can enhance resilience and potential returns. The key is to ride the waves, adapting strategies to the rhythm of the economic dance.

The Indian Context:

The Indian economy, though resilient, is not immune to global economic headwinds. Factors like global trade wars, commodity price fluctuations, and geopolitical tensions can trigger cyclical fluctuations. Recent years have witnessed India navigate the challenges of the COVID-19 pandemic and the ongoing global inflation crisis, highlighting the importance of adapting investment strategies to the evolving economic landscape.

Insights Backed by Data:

Let’s delve into some data to illustrate the impact of economic cycles on Indian investments:

- GDP Growth: India’s GDP growth rate, a key indicator of economic activity, has fluctuated between 3.1% and 8.2% over the past decade. Understanding the historical trends and current projections can help investors identify potential entry and exit points for different asset classes.

- Inflation: Inflation, a measure of price changes, can significantly impact investment returns. In India, inflation has averaged around 6% over the past decade, reaching a high of 7.79% in May 2022. Investors should consider inflation-adjusted returns when making investment decisions.

- Interest Rates: Interest rates, the cost of borrowing, play a crucial role in shaping investment decisions. As the economy expands, interest rates tend to rise, making borrowing more expensive. Conversely, during downturns, interest rates may fall, making investment in debt instruments like bonds more attractive.

- Sectoral Performance: Different sectors are differentially impacted by economic cycles. For example, infrastructure and consumer discretionary sectors tend to flourish during expansionary phases, while defensive sectors like healthcare and consumer staples perform better during downturns. Understanding these sectoral dynamics can help investors allocate their capital strategically.

Investment Strategies for the Indian Cycle:

Armed with this understanding of economic cycles and their impact on the Indian context, investors can implement various strategies to navigate the market fluctuations:

- Asset Allocation: Diversification across different asset classes like equities, bonds, real estate, and gold can help mitigate risk and provide stability during volatile periods.

- Active Management: Actively managing your portfolio and adjusting your asset allocation based on economic forecasts and market conditions can help you capitalize on opportunities and mitigate losses.

- Long-Term Focus: While economic cycles may present short-term challenges, a long-term investment horizon can smooth out the bumps and allow you to reap the benefits of compounding returns over time.

- Seek Professional Guidance: Consulting with a qualified financial advisor can be invaluable in navigating the complexities of the Indian market and developing a personalized investment strategy aligned with your risk tolerance and financial goals.

Conclusion:

Understanding economic cycles is not just about predicting the future; it’s about making informed investment decisions in the present. By acknowledging the cyclical nature of the Indian economy, analyzing relevant data, and implementing appropriate strategies, investors can ride the waves of economic fluctuations and secure their financial future. Remember, the key is to stay informed, adapt your approach, and remain focused on your long-term goals.