Introduction

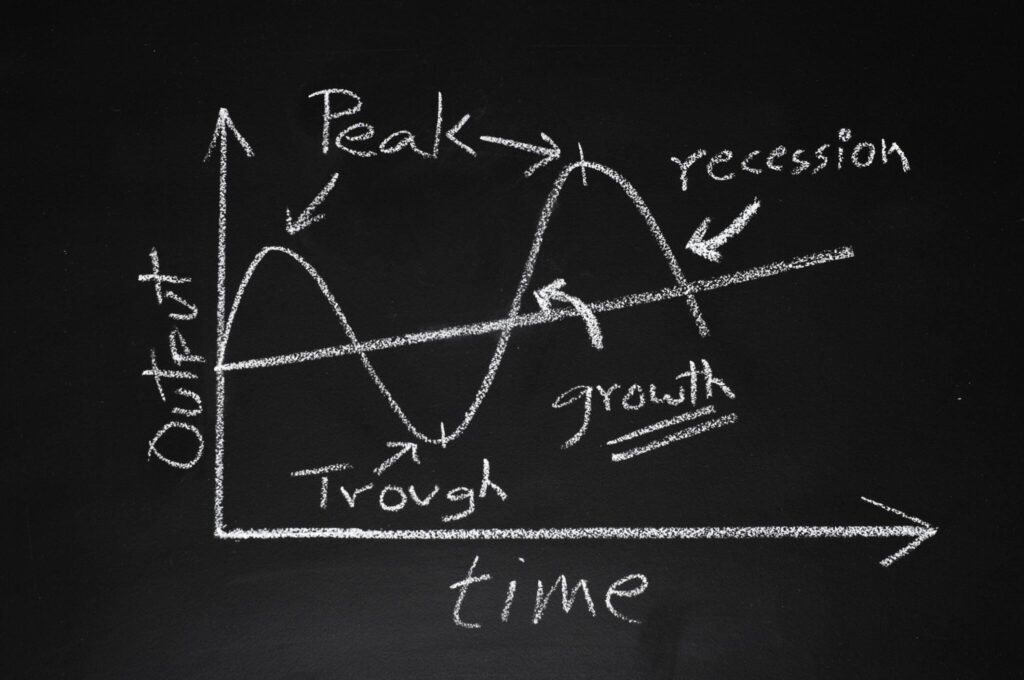

Technical analysis is a popular method of evaluating securities by analyzing statistics gathered from trading activity, such as past price movements, volume, and trading momentum. Technical analysis is often used by day traders and short-term investors who need to make quick decisions about buying and selling securities.

In India, technical analysis is a widely used tool for stock market investors. There are a number of technical indicators that are commonly used by Indian traders. Some of the most popular technical indicators include:

- Moving averages: Moving averages are a trend-following indicator that shows the average price of a security over a given period of time.

- Moving average convergence divergence (MACD): MACD is a momentum indicator that measures the relationship between two moving averages.

- Relative strength index (RSI): RSI is a momentum indicator that measures the speed and magnitude of price movements.

- Bollinger Bands: Bollinger Bands are volatility indicators that show the relative width of a security’s price range.

Technical indicators can be used to identify trends, support and resistance levels, and overbought and oversold conditions. However, it is important to remember that technical indicators are not a perfect predictor of future prices. They should always be used in conjunction with other fundamental analysis techniques.

Here are some of the benefits of using technical indicators:

- Can help to identify trends: Technical indicators can help traders to identify trends in the market. This can be helpful for making decisions about when to buy or sell securities.

- Can help to identify support and resistance levels: Support and resistance levels are areas where the price of a security is likely to find support or resistance. This can be helpful for setting stop-loss orders and profit targets.

- Can help to identify overbought and oversold conditions: Overbought and oversold conditions are situations where the price of a security is likely to reverse course. This can be helpful for making decisions about when to buy or sell securities.

Here are some of the limitations of using technical indicators:

- Can be lagging indicators: Technical indicators are based on historical data. This means that they can be lagging indicators, meaning that they may not provide a real-time picture of the market.

- Can be subjective: Technical indicators can be subjective, meaning that different traders may interpret the same data differently.

- Can be misleading: Technical indicators can be misleading, especially in volatile markets.

Despite these limitations, technical indicators can be a valuable tool for Indian stock market investors. When used correctly, technical indicators can help traders to make more informed trading decisions.

Here are some tips for using technical indicators effectively:

- Use a variety of indicators: Don’t rely on just one technical indicator. Use a variety of indicators to get a more complete picture of the market.

- Use indicators in conjunction with other analysis techniques: Technical indicators should be used in conjunction with other fundamental analysis techniques.

- Don’t overtrade: Technical indicators can be helpful for making trading decisions, but they should not be used to overtrade.

Technical analysis can be a helpful tool for Indian stock market investors. However, it is important to use technical indicators correctly and to remember that they are not a perfect predictor of future prices.